Professional illustration about Mastercard

PayPal in 2025 Overview

PayPal in 2025 Overview

As one of the leading fintech giants, PayPal continues to dominate the digital wallet and payment processing landscape in 2025, offering a suite of financial tools tailored for both consumers and businesses. The platform has evolved beyond its roots as a simple money transfer service, now integrating advanced features like AI-driven retail recommendations, buy now pay later (BNPL) options, and seamless merchant integration with major retailers such as NewEgg and Adorama. With over 400 million active users globally, PayPal remains a go-to for secure, instant checkout experiences, backed by robust fraud detection systems that leverage machine learning to safeguard transactions.

One of PayPal’s standout offerings in 2025 is its lineup of financial products, including the PayPal Cashback Mastercard, PayPal Credit Card, and PayPal Debit Card. These cards, issued in partnership with Synchrony Bank, The Bancorp Bank, and WebBank, cater to diverse spending habits. For instance, the PayPal Cashback Mastercard rewards users with unlimited cash back on purchases, while the PayPal Credit Card offers flexible financing options. The debit card, linked directly to users’ PayPal balances, provides FDIC insurance through partner banks, ensuring funds are protected up to the legal limit.

The company has also deepened its ties with Mastercard, enhancing cardholder benefits like contactless payments and global acceptance. Meanwhile, PayPal’s subsidiary Venmo remains a favorite for peer-to-peer transactions, especially among younger demographics, with social features that make splitting bills or paying friends as easy as sending a text.

In the realm of cryptocurrency, PayPal has expanded its collaboration with Paxos Trust Company to support more digital assets, allowing users to buy, sell, and hold crypto directly within their accounts. This move aligns with the growing demand for financial technology that bridges traditional and decentralized finance.

For merchants, PAYPAL INC has rolled out smarter payment systems, including AI-powered tools that optimize checkout flows and reduce cart abandonment. Small businesses, in particular, benefit from PayPal’s payment security measures, which include tokenization and encryption to prevent data breaches.

Looking ahead, PayPal’s strategy focuses on personalization—using AI to tailor shopping experiences—and expanding its financial services to underbanked regions. Whether you’re a frequent online shopper, a small business owner, or a crypto enthusiast, PayPal’s 2025 ecosystem is designed to streamline how you manage money in an increasingly digital world.

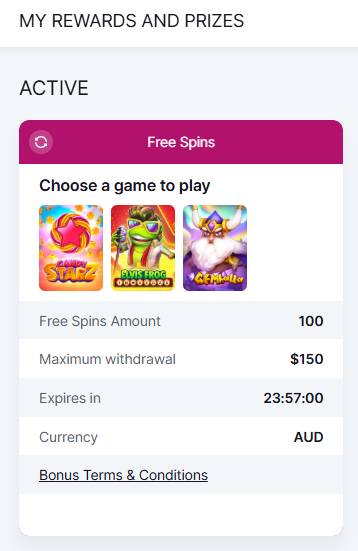

Professional illustration about PayPal

How PayPal Works Today

How PayPal Works Today

In 2025, PayPal remains a powerhouse in the fintech space, offering a seamless digital wallet experience alongside a suite of financial tools. At its core, PayPal simplifies payment processing by allowing users to link bank accounts, credit cards, or debit cards—including its own PayPal Credit Card, PayPal Debit Card, and PayPal Cashback Mastercard—to send, receive, and spend money securely. The platform’s instant checkout feature is a game-changer for online shoppers, enabling one-click purchases at major retailers like NewEgg and Adorama, while its AI-driven retail tools personalize the shopping experience by suggesting deals or optimizing payment methods.

For those who prefer flexibility, PayPal’s buy now pay later (BNPL) option splits purchases into interest-free installments, competing with services like Venmo. Behind the scenes, partnerships with Synchrony Bank, The Bancorp Bank, and WebBank ensure smooth transactions, while FDIC insurance safeguards eligible balances. Security is a top priority, with advanced fraud detection algorithms and encryption protocols protecting users’ data. Merchants also benefit from easy merchant integration, allowing businesses of all sizes to accept PayPal payments with minimal setup.

Beyond traditional payments, PayPal has embraced cryptocurrency, partnering with Paxos Trust Company to enable users to buy, sell, and hold digital assets directly in their wallets. This move aligns with the growing demand for alternative financial services in the digital age. Whether you’re splitting bills with friends, shopping online, or managing subscriptions, PayPal’s payment systems are designed for speed and convenience. The PAYPAL INC ecosystem continues to evolve, integrating AI shopping features and expanding its money transfer capabilities to stay ahead in the competitive fintech landscape.

Here’s a quick breakdown of how PayPal functions in everyday scenarios:

- Peer-to-peer transfers: Send money to friends or family instantly using just an email or phone number.

- Online purchases: Check out faster with saved payment methods and enjoy cash back rewards with eligible cards.

- Bill payments: Schedule recurring payments for subscriptions or utilities directly from your PayPal balance.

- Cryptocurrency trading: Swap Bitcoin, Ethereum, or other supported coins with a few taps.

With its blend of user-friendly features and robust payment security, PayPal remains a go-to for millions—whether you’re a casual shopper, a freelancer, or a business owner. The platform’s adaptability to trends like AI-driven retail and financial technology innovations ensures it stays relevant in an ever-changing market.

Professional illustration about Mastercard

PayPal Fees Explained

Understanding PayPal Fees in 2025: What You Need to Know

PayPal remains one of the most popular digital wallets for online transactions, but its fee structure can be confusing. Whether you're using PayPal Credit Card, PayPal Debit Card, or the PayPal Cashback Mastercard, fees vary depending on the service. For personal transactions, sending money via Venmo or PayPal using a linked bank account or PayPal balance is free, but instant transfers to your bank incur a 1.5% fee (capped at $15). Merchants pay payment processing fees ranging from 1.9% to 3.5% per transaction, plus a fixed fee based on currency—this is critical for businesses integrating merchant integration tools like NewEgg or Adorama.

Breaking Down Common PayPal Fees

- Goods and Services Payments: When buying or selling, PayPal charges 2.99% for U.S. transactions, slightly higher for international payments. This includes payment security features like fraud detection and buyer protection.

- Instant Transfer Fees: Need cash fast? Instant transfers to eligible debit cards or banks cost 1.5% (minimum $0.25, max $15), while standard transfers are free but take 1-3 days.

- Cryptocurrency Transactions: PayPal's partnership with Paxos Trust Company allows crypto buys/sells, but fees apply—typically 1.5% per trade, varying by market conditions.

- Buy Now, Pay Later (BNPL): PayPal’s AI-driven retail solutions include interest-free installment plans, but late payments trigger fees up to $20, depending on the purchase amount.

Card-Specific Fees and Perks

The PayPal Cashback Mastercard, issued by Synchrony Bank, offers 2% cash back on all purchases with no annual fee—a standout in financial technology. However, cash advances cost 5% (min $10) plus high APR. The PayPal Debit Card, backed by The Bancorp Bank, lets you spend your PayPal balance fee-free at ATMs within the Mastercard network, but out-of-network withdrawals cost $2.50. For PayPal Credit, late payments incur up to $40 fees, and interest rates hover around 28.99% APR if balances aren’t paid monthly.

Pro Tips to Minimize Fees

- Use Bank Transfers: Avoid instant transfer fees by opting for standard (free) transfers.

- Leverage Cashback: Maximize rewards with the PayPal Cashback Mastercard for everyday spending.

- Monitor Currency Conversions: PayPal’s exchange rates include a markup—consider using a multi-currency account for international deals.

- Avoid Chargebacks: Disputes may lead to $20 fees; communicate with sellers first to resolve issues.

FDIC Insurance and Financial Safety

Funds in your PayPal balance are held by WebBank or PAYPAL INC, but only eligible accounts are FDIC-insured up to $250,000. For added payment security, enable two-factor authentication and link cards instead of keeping large balances in PayPal. The platform’s AI shopping tools also help detect suspicious activity, but users should regularly review transaction histories.

Whether you're a freelancer, shopper, or business owner, understanding PayPal’s 2025 fee structure ensures you avoid surprises while leveraging its financial services effectively. Keep an eye on updates—fintech evolves fast, and PayPal frequently tweaks its policies to stay competitive.

Professional illustration about Venmo

PayPal Security Features

PayPal Security Features: How Your Money Stays Protected in 2025

When it comes to payment security, PayPal remains a leader in fintech, offering robust safeguards for users of its digital wallet, PayPal Credit Card, and PayPal Cashback Mastercard. The platform leverages advanced fraud detection systems powered by AI, ensuring unauthorized transactions are flagged instantly. For example, if someone tries to use your PayPal Debit Card for an unusual purchase, the system may temporarily freeze the transaction and send an alert to verify its legitimacy. This AI-driven retail protection is particularly useful for frequent shoppers at merchants like NewEgg or Adorama, where high-ticket items are common targets for fraud.

One of PayPal’s standout features is its buy now, pay later (BNPL) security protocols. When you split payments into installments, PayPal encrypts your data end-to-end, so sensitive details like your bank account or Mastercard information are never exposed to merchants. Even when linking external accounts (like Venmo or Synchrony Bank-issued cards), PayPal uses tokenization—replacing your actual card numbers with randomized digital tokens—to prevent breaches. This is critical for money transfer safety, especially with the rise of cryptocurrency integrations through partners like Paxos Trust Company.

For added peace of mind, PayPal’s financial services are backed by FDIC insurance (for eligible accounts through The Bancorp Bank or WebBank), meaning your balance is protected up to $250,000. The platform also offers 24/7 transaction monitoring and purchase protection, which covers eligible items if they’re not delivered or match their description. Say you buy a laptop using PayPal Credit Card and it arrives damaged—you can file a dispute directly through the app, and PayPal’s team will mediate with the seller.

Merchant integrations also benefit from PayPal’s security infrastructure. Businesses using payment processing tools get access to instant checkout features like One Touch™, which reduces cart abandonment while keeping customer data secure. Plus, PAYPAL INC complies with global standards like PCI-DSS (Payment Card Industry Data Security Standard), ensuring all transactions meet stringent encryption requirements. Whether you’re a freelancer receiving payments or a shopper using AI shopping recommendations, PayPal’s multi-layered defenses—from biometric login to two-factor authentication—keep your financial technology interactions safe in 2025.

Here’s a quick breakdown of key protections:

- Encryption & Tokenization: Every transaction is shielded with military-grade encryption, and card details are replaced with tokens.

- Purchase Protection: Covers eligible purchases for refunds or replacements if issues arise.

- Real-Time Alerts: Notifications for every transaction, including those via PayPal Cashback Mastercard or linked banks.

- Seller Protection: Guards businesses against fraudulent chargebacks when they follow PayPal’s guidelines.

With scams becoming more sophisticated, PayPal continuously updates its systems. For instance, its AI-driven retail tools now analyze patterns like device fingerprints and location data to spot anomalies—so even if someone steals your login, unusual activity (e.g., a sudden international purchase) would trigger extra verification. Combine that with the ease of instant checkout, and it’s clear why millions trust PayPal for payment systems that balance convenience with ironclad security.

Professional illustration about FDIC

PayPal for Businesses

PayPal for Businesses

For businesses in 2025, PayPal remains a powerhouse in payment processing, offering a suite of tools designed to streamline transactions, enhance security, and boost revenue. Whether you're a small eCommerce store or a large enterprise, PayPal’s merchant integration solutions provide seamless instant checkout experiences, reducing cart abandonment rates. With AI-driven retail trends dominating the market, PayPal’s fraud detection algorithms leverage machine learning to minimize chargebacks while ensuring payment security—a critical advantage in an era where digital fraud is increasingly sophisticated.

One of PayPal’s standout features for businesses is its flexibility in payment systems. Companies can accept payments via digital wallet, credit/debit cards (including the PayPal Credit Card and PayPal Debit Card), and even cryptocurrency through partnerships with Paxos Trust Company. For merchants looking to offer financing options, buy now pay later (BNPL) services attract budget-conscious shoppers, while the PayPal Cashback Mastercard (issued by Synchrony Bank) incentivizes repeat purchases with cash back rewards. Major retailers like NewEgg and Adorama leverage these tools to drive customer loyalty and increase average order values.

Behind the scenes, PayPal’s infrastructure is backed by trusted financial institutions like The Bancorp Bank and WebBank, ensuring FDIC-insured stability for business accounts. The platform also integrates with Venmo, expanding reach to younger demographics who prefer social payment apps. For global operations, PayPal supports multi-currency transactions, making cross-border sales frictionless.

From a technical standpoint, PayPal’s APIs enable deep merchant integration with platforms like Shopify, WooCommerce, and Salesforce. The AI shopping tools analyze customer behavior to personalize checkout flows, while money transfer features simplify payouts to vendors or freelancers. For businesses wary of fees, PayPal’s transparent pricing tiers (including discounted rates for nonprofits) make it easier to scale without unexpected costs.

In 2025, PAYPAL INC continues to lead in fintech innovation, offering businesses not just a financial service, but a growth engine. Whether it’s tapping into AI-driven retail trends or leveraging financial technology to secure transactions, PayPal provides the tools to stay competitive in a rapidly evolving digital economy.

Professional illustration about Bancorp

PayPal vs Competitors

When comparing PayPal to its competitors in 2025, it’s clear that the fintech giant still holds a strong position in digital wallet and payment processing, but rivals like Venmo (owned by PayPal Inc.) and newer AI-driven retail platforms are pushing the boundaries. PayPal’s ecosystem, which includes the PayPal Cashback Mastercard, PayPal Credit Card, and PayPal Debit Card, offers seamless integration with millions of merchants like NewEgg and Adorama, thanks to its instant checkout feature. However, competitors are catching up by offering higher cash back rates or more flexible buy now pay later options. For example, while PayPal’s credit products are issued through Synchrony Bank, The Bancorp Bank, and WebBank, some rivals partner with institutions offering lower interest rates or better rewards structures.

One area where PayPal excels is payment security and fraud detection, leveraging advanced AI to protect users. Its FDIC-insured balances through partner banks provide peace of mind, but newer platforms are integrating cryptocurrency services more aggressively—like Paxos Trust Company-backed solutions—which PayPal has been slower to adopt. Meanwhile, Venmo, while under the same corporate umbrella, appeals to a younger demographic with social payment features, though it lacks some of PayPal’s merchant integration depth.

For small businesses, PayPal’s payment systems are a double-edged sword. Its fees are competitive but not always the lowest, and alternatives are emerging with transparent pricing and faster money transfer times. Where PayPal stands out is its global reach; many international sellers rely on it for cross-border transactions. Yet, local financial service providers in regions like Europe and Asia are gaining traction with localized solutions, challenging PayPal’s dominance.

The PayPal Credit Card and Mastercard-backed offerings remain popular for their cash back rewards, but tech-savvy users are increasingly drawn to AI shopping tools from competitors that personalize discounts in real-time. PayPal’s financial technology is robust, but innovation in fraud detection and user experience is now table stakes. For instance, some competitors use machine learning to predict spending habits and adjust credit limits dynamically—a feature PayPal has yet to fully embrace.

Ultimately, choosing between PayPal and its competitors depends on your priorities. If you value a trusted digital wallet with extensive merchant integration, PayPal is hard to beat. But if you’re after cutting-edge fintech features like AI-driven retail discounts or niche buy now pay later plans, exploring alternatives might pay off. The key is to weigh fees, security, and convenience—because in 2025, the payment processing landscape is more competitive than ever.

Professional illustration about Company

PayPal Mobile App Guide

The PayPal Mobile App is your all-in-one financial hub, seamlessly integrating digital wallet convenience with powerful payment processing tools. Whether you're using a PayPal Credit Card, PayPal Debit Card, or the PayPal Cashback Mastercard, the app transforms your smartphone into a secure financial command center. With over 400 million active users globally, PayPal continues to dominate the fintech space by offering AI-driven features like instant checkout and personalized cash back rewards.

Key Features You Should Master:

- One-Tap Payments: Link your Mastercard or bank account for frictionless transactions at merchants like NewEgg or Adorama. The app's AI shopping algorithms even suggest optimal payment methods based on your purchase history.

- Buy Now, Pay Later: Split purchases into 4 interest-free payments directly through the app—a game-changer for budget-conscious shoppers.

- Crypto & Venmo Integration: Manage cryptocurrency holdings via Paxos Trust Company partnerships or send money to friends through Venmo without leaving the app.

- Advanced Security: Real-time fraud detection and FDIC insurance (through partner banks like Synchrony Bank and The Bancorp Bank) keep your funds safe.

Pro Tips for Power Users:

1. Enable instant checkout for faster merchant integration—stores with PayPal buttons will auto-fill your shipping/payment details.

2. Use the PayPal Cashback Mastercard for 2% back on all purchases (3% when paying through PayPal). Track rewards in-app with a dedicated dashboard.

3. Leverage AI-driven retail insights: The app analyzes spending patterns to surface limited-time cashback deals (e.g., "Spend $50 at grocery stores, get 5% back").

Behind the Scenes:

PayPal’s payment systems rely on a network of partner banks (WebBank, Synchrony Bank) to process transactions. The app also supports money transfer to 200+ countries with competitive FX rates. For businesses, the merchant integration API allows custom payment flows—perfect for e-commerce platforms.

Troubleshooting & Hidden Gems:

- Lost your card? Freeze your PayPal Debit Card instantly in the app under "Card Controls."

- The "Money Pools" feature lets groups collect funds for gifts or events—ideal for shared expenses.

- Enable biometric login (Face ID/fingerprint) for added payment security.

With continuous 2025 updates like AR-powered receipt scanning and expanded buy now pay later options, the PayPal app remains the gold standard in financial technology. Whether you’re splitting bills or investing in crypto, its financial services ecosystem adapts to every need.

Professional illustration about PAYPAL

PayPal Buyer Protection

PayPal Buyer Protection is one of the standout features that make PayPal a trusted digital wallet for millions of users worldwide. Whether you're using a PayPal Credit Card, PayPal Debit Card, or even the PayPal Cashback Mastercard, this safeguard ensures you're covered if something goes wrong with your purchase. The program is designed to protect buyers against fraud detection, undelivered items, or products that don’t match the seller’s description. For example, if you buy a high-end camera from NewEgg or Adorama and it arrives damaged or isn’t what you ordered, PayPal’s payment security measures can help you get a full refund—no questions asked.

One of the key advantages of PayPal Buyer Protection is its seamless integration with merchant integration platforms, making it easier for shoppers to dispute transactions directly through their PayPal account. The process is straightforward: if an issue arises, you have 180 days from the purchase date to file a claim. PayPal’s AI-driven retail systems then review the case, often resolving disputes within weeks. This is particularly useful for high-ticket items or when shopping with lesser-known vendors. Plus, because PayPal partners with Synchrony Bank, The Bancorp Bank, and WebBank for its financial services, you can trust that your money is handled securely and backed by FDIC protections where applicable.

Another layer of security comes from PayPal’s collaboration with Mastercard, which adds an extra level of payment processing safety for cardholders. For instance, if you use your PayPal Cashback Mastercard to make a purchase, you benefit from both PayPal’s buyer protection and Mastercard’s own zero liability policy. This dual coverage is a game-changer for online shoppers who want peace of mind. Even when using Venmo (owned by PAYPAL INC) for peer-to-peer transactions, certain eligible purchases may qualify for protection, though the rules differ slightly from PayPal’s core services.

For those who love cash back rewards or buy now pay later options, PayPal’s fintech innovations ensure that buyer protection extends to these features as well. Let’s say you use PayPal’s Pay in 4 installment plan to buy a laptop—you’re still covered if the seller fails to deliver. Additionally, with the rise of cryptocurrency transactions through Paxos Trust Company, PayPal has adapted its policies to include limited protections for crypto purchases, though these are subject to specific terms.

Here are a few pro tips to maximize PayPal Buyer Protection:

- Always check that the seller’s website has instant checkout enabled with PayPal, as this often indicates a verified merchant.

- Keep records of all communications with the seller, including order confirmations and shipping details.

- Be aware that certain items, like real estate or vehicles, are typically excluded from protection.

By leveraging these features, shoppers can enjoy a safer, more secure money transfer experience. Whether you’re a frequent online buyer or just dipping your toes into financial technology, PayPal’s robust protections make it a top choice for hassle-free transactions.

Professional illustration about Adorama

PayPal Seller Policies

Understanding PayPal Seller Policies in 2025

If you're a merchant using PayPal for payment processing, it's crucial to stay updated with their seller policies to avoid disputes, fees, or account limitations. PayPal has refined its policies in 2025 to enhance payment security and streamline merchant integration, making it easier for businesses—from small fintech startups to established retailers like NewEgg and Adorama—to operate smoothly.

Key Updates in PayPal’s 2025 Seller Policies

One major change is the stricter fraud detection measures. PayPal now uses AI-driven retail tools to flag suspicious transactions, reducing chargebacks. Sellers must ensure their product descriptions are accurate and shipping timelines are clearly stated to avoid disputes. For example, if you sell electronics and promise "2-day delivery," but delays occur, buyers can file claims more easily under the updated policies.

Another critical update involves buy now pay later (BNPL) services. If you accept PayPal’s installment payments, refunds must now be processed within 10 business days (down from 14 in previous years). This aligns with Mastercard and Synchrony Bank standards, which power the PayPal Credit Card and PayPal Cashback Mastercard.

Handling Disputes and Chargebacks

PayPal’s seller protection program still covers eligible transactions, but the criteria are tighter. To qualify:

- Ship to the address listed on the PayPal transaction details (no exceptions).

- Provide tracking info within 7 days for physical goods.

- Avoid selling high-risk items like cryptocurrencies (handled by Paxos Trust Company) or gift cards, which are often flagged for fraud.

For digital goods or services, sellers must submit proof of delivery (e.g., login timestamps or email confirmations). If a buyer claims they didn’t receive a service, PayPal’s AI shopping algorithms cross-check usage data to validate claims.

Fees and Financial Services

PayPal’s fee structure remains competitive, but micro-transactions (under $10) now have a flat 5% fee instead of the standard 2.9% + $0.30. This impacts small-ticket sellers, especially those using Venmo for peer-to-peer sales. If you’re a high-volume seller, consider applying for PayPal’s Merchant Rate Program, which offers discounts based on monthly sales.

For funding, PayPal partners with The Bancorp Bank and WebBank to offer instant transfers to linked PayPal Debit Card accounts. Funds are FDIC-insured, but transfers to external banks may take 1-3 days unless you pay a 1.5% instant transfer fee.

Pro Tips for Compliance

- Use PayPal’s instant checkout buttons to reduce cart abandonment.

- Enable money transfer notifications to alert buyers about order status, reducing disputes.

- Regularly review PayPal’s financial technology updates—their blog and seller portal announce policy changes quarterly.

By adhering to these policies, sellers can minimize risks and maximize the benefits of PayPal’s payment systems, ensuring a seamless experience for both businesses and customers.

PayPal International Transfers

PayPal International Transfers offer a seamless way to send and receive money across borders, making it a top choice for freelancers, small businesses, and online shoppers in 2025. With over 400 million active accounts worldwide, PayPal’s digital wallet simplifies cross-border transactions by supporting 56 currencies and operating in 200+ markets. Whether you’re paying for services, splitting bills with friends on Venmo, or shopping at global retailers like NewEgg or Adorama, PayPal’s payment processing system ensures fast, secure transfers with competitive exchange rates.

One of the standout features is PayPal’s partnership with Mastercard, which powers the PayPal Cashback Mastercard, PayPal Credit Card, and PayPal Debit Card. These cards enhance international spending by offering cash back rewards, buy now pay later options, and low foreign transaction fees. For instance, the PayPal Cashback Mastercard gives 2% cash back on all purchases, including international ones, while the PayPal Credit Card provides flexible financing through Synchrony Bank. Funds held in PayPal accounts are also FDIC-insured through partner banks like The Bancorp Bank, WebBank, and Paxos Trust Company, adding an extra layer of security.

Security is a priority for PAYPAL INC, leveraging AI-driven fraud detection and payment security protocols to protect users. The platform’s fintech innovations include cryptocurrency support, allowing users to buy, sell, and hold Bitcoin or Ethereum directly in their wallets. For merchants, PayPal’s instant checkout and merchant integration tools streamline global sales, reducing cart abandonment rates.

Here’s how to optimize international transfers with PayPal:

- Check exchange rates upfront: PayPal displays the conversion rate before confirming a transfer, but compare it with your bank’s rate for the best deal.

- Use PayPal-linked cards: The PayPal Debit Card avoids currency conversion markups when withdrawing cash abroad.

- Leverage “Friends and Family” for fee-free transfers: While PayPal charges fees for business transactions, personal transfers between verified accounts (like splitting a vacation bill via Venmo) are often free.

- Enable two-factor authentication: Boost payment security to prevent unauthorized access during cross-border transactions.

For frequent international users, PayPal’s money transfer speed is a game-changer—transfers typically complete within 1-3 business days, far faster than traditional banks. Small businesses benefit from AI shopping tools that automate invoicing and detect fraudulent activity, while consumers enjoy AI-driven retail features like personalized currency conversion suggestions.

Despite its advantages, PayPal’s fees for cross-border financial services can add up. For example, sending money internationally incurs a 5% fee (capped at $4.99) plus a fixed currency spread. However, the convenience of instant checkout and fraud detection often outweighs the cost for high-value transactions.

In 2025, PayPal continues to dominate financial technology with innovations like crypto-to-fiat conversions and partnerships with Mastercard for contactless payments. Whether you’re a freelancer receiving payments from overseas clients or a shopper buying from NewEgg’s global inventory, PayPal’s payment systems provide a reliable, user-friendly solution for international money transfers.

PayPal Cryptocurrency Support

PayPal Cryptocurrency Support in 2025: What You Need to Know

Since its launch in 2020, PayPal’s cryptocurrency support has evolved significantly, making it one of the most accessible digital wallet solutions for buying, selling, and holding crypto. In 2025, PayPal continues to expand its offerings, allowing users to transact with Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) seamlessly. What sets PayPal apart is its integration with everyday spending—users can now convert crypto to fiat instantly at checkout with millions of merchants, including NewEgg and Adorama, thanks to partnerships with Mastercard and Paxos Trust Company.

For those who prefer traditional payment methods but still want crypto flexibility, the PayPal Cashback Mastercard and PayPal Credit Card offer cash back rewards that can be reinvested into cryptocurrency. Meanwhile, the PayPal Debit Card enables direct spending from your PayPal balance, including converted crypto funds. Security is a top priority, with fraud detection powered by AI and FDIC insurance for cash balances held through partner banks like Synchrony Bank, The Bancorp Bank, and WebBank.

One of the standout features in 2025 is PayPal’s buy now pay later option, which now includes crypto-backed financing. For instance, users can collateralize their crypto holdings to split purchases into interest-free installments—a game-changer for AI-driven retail experiences. Venmo, PayPal’s sibling platform, also supports crypto transactions, making peer-to-peer money transfer smoother than ever.

Behind the scenes, PAYPAL INC leverages financial technology to streamline payment processing. Their payment systems use blockchain analytics for payment security, ensuring compliance while minimizing delays. Merchants benefit from merchant integration tools that accept crypto payments without handling volatility risks—PayPal automatically converts crypto to USD at instant checkout.

For newcomers, PayPal simplifies crypto investing with educational resources and AI shopping tools that suggest optimal times to buy or sell based on market trends. However, critics note that PayPal’s custodial model means users don’t own private keys, which may deter hardcore crypto enthusiasts. Still, for mainstream adoption, PayPal’s financial service bridge between fiat and crypto remains unmatched in convenience.

Looking ahead, rumors suggest PayPal may add support for stablecoins or NFTs, further solidifying its role in fintech innovation. Whether you’re a casual spender or a crypto-curious investor, PayPal’s 2025 ecosystem offers a balanced mix of flexibility, security, and real-world utility.

PayPal Credit Options

PayPal Credit Options

When it comes to flexible payment solutions, PayPal offers a variety of credit options designed to fit different financial needs. Whether you're shopping online at retailers like NewEgg or Adorama or managing day-to-day expenses, PayPal’s financial tools—backed by trusted partners like Synchrony Bank, The Bancorp Bank, and WebBank—provide secure and convenient ways to pay.

One of the most popular options is the PayPal Credit Card, which functions like a traditional Mastercard but with added perks. Cardholders enjoy cash back rewards, seamless integration with the PayPal digital wallet, and AI-driven fraud detection for secure transactions. Another standout is the PayPal Cashback Mastercard, which offers unlimited 2-3% cash back on purchases, making it ideal for frequent shoppers. Both cards sync effortlessly with PayPal’s instant checkout feature, streamlining the payment process across thousands of merchants.

For those who prefer a buy now, pay later approach, PayPal Credit (formerly known as Bill Me Later) allows users to split purchases into interest-free installments, a feature especially useful for bigger-ticket items. This fintech innovation competes with services like Venmo but stands out due to its broad merchant integration and robust payment security.

Debit card users aren’t left out—the PayPal Debit Card, issued by The Bancorp Bank, provides direct access to your PayPal balance with FDIC insurance protection. It also supports cryptocurrency transactions through Paxos Trust Company, catering to modern spending habits.

Here’s a quick breakdown of key features across PayPal’s credit options:

- PayPal Credit Card: Combines rewards with AI shopping optimizations, ideal for online retail.

- PayPal Cashback Mastercard: Best for high cash-back earnings on all purchases.

- PayPal Credit: Flexible installment plans with no hidden fees.

- PayPal Debit Card: Instant access to funds, plus crypto support.

Each option is designed to enhance payment processing while prioritizing fraud detection and user convenience. Whether you’re leveraging financial technology for everyday spending or large purchases, PayPal’s credit solutions adapt to your lifestyle—backed by industry leaders like PAYPAL INC and Mastercard. The key is choosing the right tool based on your spending habits and financial goals.

PayPal Customer Support

PayPal Customer Support is a critical aspect of the platform’s user experience, especially as PayPal continues to expand its financial services, including the PayPal Cashback Mastercard, PayPal Credit Card, and PayPal Debit Card. In 2025, the company has streamlined its support channels to cater to over 400 million users worldwide, leveraging AI-driven retail tools and fraud detection systems to resolve issues faster. Whether you’re dealing with payment processing delays, disputes, or questions about buy now pay later options, PayPal offers multiple ways to get help, including 24/7 live chat, phone support, and an extensive help center.

One of the standout features of PayPal’s customer support is its integration with Mastercard and partner banks like Synchrony Bank, The Bancorp Bank, and WebBank. For example, if you encounter issues with your PayPal Cashback Mastercard, you can contact Synchrony Bank directly for card-specific inquiries, while general PayPal account issues are handled by PayPal’s own team. This dual-layer support ensures that users get specialized assistance tailored to their needs. Additionally, PayPal’s digital wallet and Venmo services have dedicated support teams, making it easier to resolve money transfer or payment security concerns.

For merchants using PayPal’s payment systems, customer support extends to merchant integration and instant checkout troubleshooting. Sellers on platforms like NewEgg or Adorama can access PayPal’s Merchant Support team for help with transaction disputes, cryptocurrency payments (powered by Paxos Trust Company), or AI shopping tools. PayPal also provides detailed guides on financial technology best practices, helping businesses optimize their checkout processes and reduce chargebacks.

Here’s how to navigate PayPal’s customer support in 2025:

- Live Chat & Phone Support: Available 24/7 for urgent issues like unauthorized transactions or account locks. Look for the “Contact Us” button in your PayPal app or website.

- Help Center: A comprehensive repository of articles covering everything from cash back rewards to FDIC insurance details for eligible accounts.

- Social Media: PayPal’s Twitter and Facebook teams respond swiftly to public inquiries, though sensitive issues should be handled via secure channels.

- Community Forum: A peer-to-peer platform where users share solutions for common problems, often with input from PayPal moderators.

If you’re dealing with fraud detection alerts or suspicious activity, PayPal’s automated systems will typically flag these issues first, followed by human review. The company’s fintech advancements in 2025 include real-time dispute resolution for eligible transactions, reducing wait times for refunds or chargebacks. For PayPal Credit Card holders, Synchrony Bank’s support portal offers additional resources like payment scheduling and credit limit increases.

Pro tip: Always check your linked funding sources (e.g., bank accounts or cards) before contacting support, as many issues stem from expired cards or insufficient balances. PayPal’s AI-driven retail tools also provide preemptive notifications for potential problems, such as failed recurring payments or currency conversion errors. By leveraging these features, users can often resolve issues without needing direct support.

Finally, PayPal’s transparency about payment security sets it apart. The company publishes annual reports on its fraud detection efficacy and partners with FDIC-insured institutions to safeguard user funds. If you’re a high-volume seller or frequently use buy now pay later services, consider enrolling in PayPal’s premium support tiers for prioritized assistance. With its blend of automation and human expertise, PayPal’s customer support in 2025 is designed to keep your financial service experience seamless.

PayPal Integration Tips

Integrating PayPal into your e-commerce platform or business workflow can significantly streamline payment processing while enhancing payment security for both merchants and customers. Whether you're selling on NewEgg or managing a boutique store on Adorama, leveraging PayPal’s digital wallet and financial services can boost conversions and simplify transactions. Here’s how to optimize your integration for seamless performance and maximum benefits.

First, choose the right PayPal product for your business model. If you're targeting customers who prefer flexible payments, enabling PayPal Credit Card or buy now pay later options can increase average order values. For merchants, integrating PayPal Debit Card or PayPal Cashback Mastercard (issued by Synchrony Bank or The Bancorp Bank) ensures quick access to funds while earning rewards. Note that PayPal’s partnerships with Mastercard and WebBank also expand its capabilities, including instant checkout and money transfer features.

Next, prioritize merchant integration best practices. Use PayPal’s official APIs or plugins (like those for Shopify or WooCommerce) to ensure compatibility and fraud detection safeguards. For example, PayPal’s AI-driven retail tools analyze transaction patterns to flag suspicious activity, reducing chargebacks. If your platform supports cryptocurrency transactions, verify compliance with Paxos Trust Company, PayPal’s partner for crypto services. Additionally, highlight PayPal’s FDIC insurance (through partner banks) to reassure customers about fund security.

Don’t overlook user experience optimizations. Enable Venmo as a payment option (where applicable) to attract younger demographics who prefer social payment apps. Simplify checkout by pre-loading PayPal’s digital wallet details for returning customers, reducing cart abandonment. For subscription-based services, leverage PayPal’s recurring billing API to automate renewals.

Finally, test rigorously. Simulate transactions using PayPal’s sandbox environment to identify bugs or latency issues. Monitor payment systems post-launch to address declines caused by expired PayPal Credit Cards or insufficient balances in PayPal Debit Card accounts. By combining these strategies, you’ll create a frictionless payment experience that aligns with modern fintech standards and drives revenue growth.

PayPal Future Trends

PayPal Future Trends

As we move through 2025, PayPal continues to redefine the fintech landscape with innovations tailored to consumer and merchant needs. One of the most anticipated trends is the expansion of AI-driven retail tools, where PayPal leverages machine learning to personalize shopping experiences. For example, its instant checkout feature now predicts buyer preferences, reducing cart abandonment rates by streamlining purchases across platforms like NewEgg and Adorama. This seamless integration not only boosts sales for merchants but also enhances user satisfaction—a win-win in the competitive payment processing space.

Another major shift is the growing adoption of buy now pay later (BNPL) services, with PayPal Credit Card leading the charge. Partnering with Synchrony Bank and WebBank, PayPal offers flexible repayment options with zero interest if paid within promotional periods. This model appeals especially to Gen Z and millennial shoppers who prioritize budget-friendly spending. Meanwhile, the PayPal Cashback Mastercard, issued by The Bancorp Bank, remains a top choice for rewards seekers, offering 2-3% cash back on eligible purchases—a perk that’s hard to beat in the digital wallet arena.

Security remains a cornerstone of PayPal’s strategy. Advanced fraud detection systems now use AI to flag suspicious transactions in real time, protecting users’ funds and data. With FDIC insurance covering balances held in PayPal’s debit card and savings products, customers enjoy peace of mind alongside convenience. The company has also deepened its ties with Mastercard to enhance global acceptance, ensuring users can tap-to-pay anywhere Mastercard is accepted—whether online or in-store.

Cryptocurrency integration is another area where PayPal is pushing boundaries. Through partnerships with Paxos Trust Company, users can buy, sell, and hold cryptocurrencies directly in their PayPal wallets. This move aligns with the rising demand for cryptocurrency as both an investment and a payment system. Additionally, Venmo, PayPal’s peer-to-peer subsidiary, has expanded its crypto services, allowing younger demographics to trade and spend digital assets effortlessly.

Looking ahead, expect PayPal to focus on merchant integration tools that simplify backend operations. Small businesses, for instance, can now automate invoicing and reconcile payments faster using PayPal’s APIs. The company’s financial technology stack is also evolving to support subscription-based models, catering to the boom in SaaS and recurring billing industries. With these advancements, PAYPAL INC solidifies its position as a leader in money transfer and financial services, continually adapting to the needs of a digital-first economy.