Professional illustration about BNB

Binance in 2025 Overview

Binance in 2025 Overview

As the world’s leading cryptocurrency exchange, Binance continues to dominate the crypto trading landscape in 2025, offering unparalleled access to digital assets like Bitcoin, Ethereum, and its native token BNB. Under the leadership of CEO Richard Teng, who succeeded Changpeng Zhao in late 2023, the platform has doubled down on regulatory compliance, crypto security, and innovation to maintain its competitive edge against rivals like Coinbase.

One of Binance’s standout features in 2025 is its expanded ecosystem, which includes Binance Smart Chain (now fully integrated with decentralized finance protocols), Binance USD (a stablecoin widely used for derivatives trading), and new initiatives like Binance Alpha and Binance MegaDrop. These programs cater to both novice and advanced traders, offering exclusive rewards, early access to projects, and educational resources for those looking to invest in crypto strategically.

For U.S. users, Binance.US remains a key player, though it operates independently with a focus on strict know your customer (KYC) and anti-money laundering (AML) policies. The platform has streamlined its onboarding process, making it easier to buy crypto while adhering to evolving regulations. Meanwhile, global users benefit from Binance’s low fees, high liquidity, and support for over 500 cryptocurrencies—making it a one-stop shop for crypto market enthusiasts.

Security remains a top priority in 2025, with Binance implementing advanced measures like multi-party computation (MPC) wallets and AI-driven fraud detection. Co-founder Yi He has emphasized the importance of user education, with free courses on blockchain technology and risk management available through Binance Academy.

The exchange’s derivatives trading platform has also seen significant upgrades, including new contract types and leverage options, though regulators continue to scrutinize this space. Despite challenges, Binance’s adaptability—coupled with its commitment to innovation—ensures it stays ahead in the fast-evolving crypto trading industry. Whether you’re a beginner or a seasoned trader, Binance offers the tools, security, and market depth needed to navigate the digital assets landscape confidently.

Professional illustration about Binance

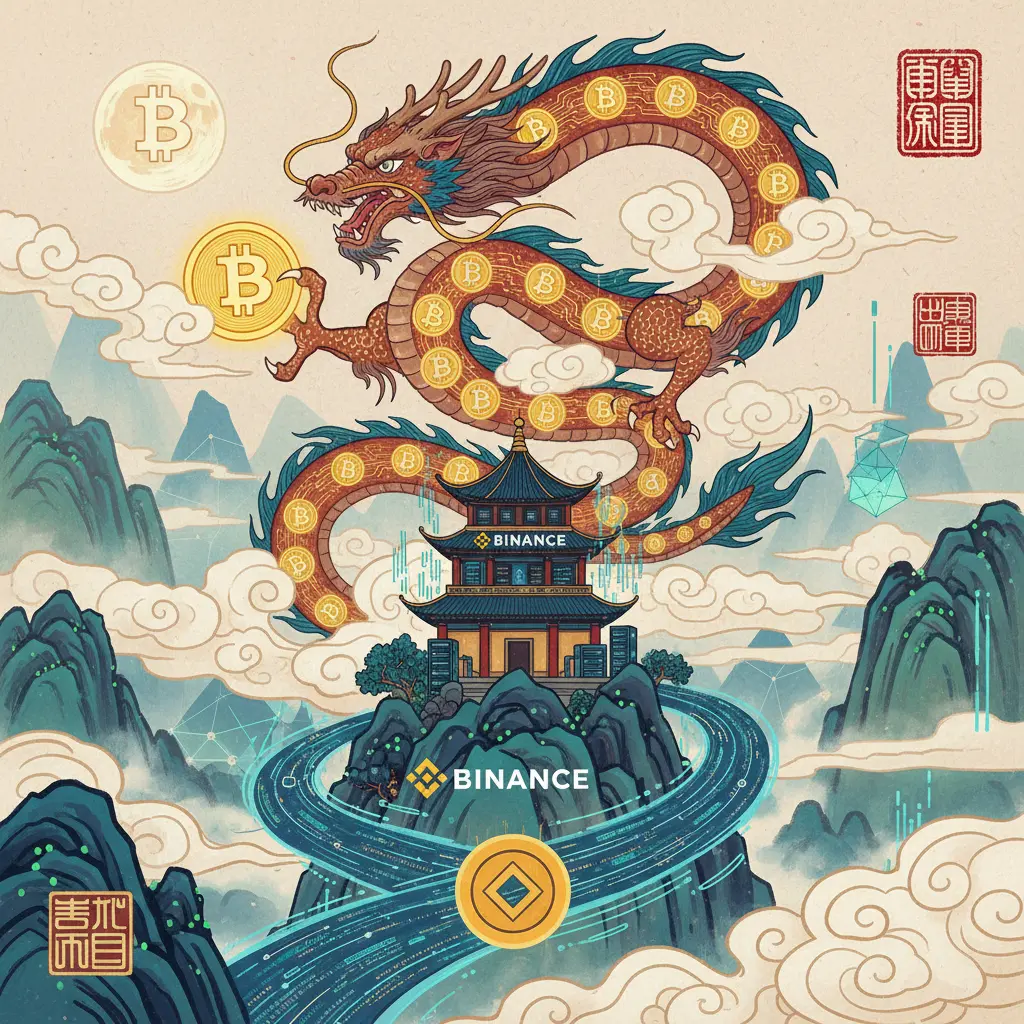

Binance Trading Fees

Binance Trading Fees: A 2025 Breakdown for Savvy Crypto Traders

When it comes to crypto trading, Binance remains one of the most cost-effective platforms, but understanding its trading fees structure is key to maximizing profits. As of 2025, Binance operates on a maker-taker fee model, with rates starting at 0.1% for spot trading. However, fees can drop as low as 0.02% for high-volume traders or those holding BNB (Binance’s native token) to pay fees. For example, using BNB slashes your fees by 25%, making it a no-brainer for active traders.

Spot vs. Derivatives: Fee Differences

Spot trading on Binance is straightforward, but derivatives like futures come with slightly higher costs. While spot trades cap at 0.1%, futures fees range from 0.02% to 0.04% for makers and 0.04% to 0.06% for takers. Pro tip: If you’re trading Bitcoin or Ethereum pairs, liquidity is high, which often means tighter spreads and lower effective costs. Binance also offers discounts for VIP tiers, which are based on 30-day trading volume or BNB holdings. Even casual traders can benefit from Level 1 (0.09% spot fee) by holding just 50 BNB.

How Binance.US Compares

For U.S. users, Binance.US follows a simpler tiered model, with fees starting at 0.1% and decreasing with higher volumes. Unlike the global platform, it doesn’t support BNB fee discounts, so traders should weigh this against alternatives like Coinbase. Regulatory changes in 2025 have tightened know your customer (KYC) and anti-money laundering (AML) policies, but Binance.US remains competitive for buying crypto with USD.

Hidden Costs and How to Avoid Them

While trading fees are transparent, withdrawal fees can eat into profits. For instance, withdrawing Bitcoin costs a flat network fee (adjusted for congestion), and Ethereum ERC-20 tokens incur gas fees. To save, consider using Binance Smart Chain (BSC) for transfers, where fees are often under $0.10. Also, watch for Binance Alpha or Binance MegaDrop promotions, which occasionally offer zero-fee trading days for select pairs.

The Role of Leadership in Fee Structures

Under Richard Teng’s leadership post-Changpeng Zhao, Binance has prioritized regulatory compliance without sacrificing affordability. New features like decentralized finance (DeFi) integrations and blockchain technology upgrades have kept fees low while improving crypto security. For example, the 2025 rollout of Binance USD (BUSD)-backed margin trading reduced borrowing costs for retail traders.

Final Takeaways for Traders

- Use BNB to cut fees by 25% and aim for VIP tiers if trading daily.

- Compare Binance.US and global fees if you’re in the U.S., as discounts differ.

- Leverage Binance Smart Chain for low-cost withdrawals and digital assets transfers.

- Stay updated on Binance MegaDrop events for temporary fee waivers.

Whether you’re a high-frequency trader or a crypto market newcomer, optimizing for Binance’s fee structure can significantly impact your bottom line. Keep an eye on announcements from Yi He and the Binance team, as fee policies may evolve with decentralized finance trends and global regulations.

Professional illustration about Binance

Binance Security Features

Binance Security Features: How the World’s Leading Crypto Exchange Keeps Your Assets Safe

When it comes to crypto trading, security is non-negotiable. Binance, under the leadership of Richard Teng and co-founder Yi He, has implemented a multi-layered security framework to protect users’ digital assets. Whether you’re trading Bitcoin, Ethereum, or BNB on Binance Smart Chain, the platform’s robust measures ensure your investments are shielded from threats.

One of Binance’s standout features is its Secure Asset Fund for Users (SAFU), an emergency insurance fund launched in 2018 and continuously updated. In 2025, SAFU holds 1% of all trading fees in a cold wallet, providing a safety net against potential breaches. This proactive approach aligns with regulatory compliance standards, including Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, which are strictly enforced across Binance.US and global platforms.

For Crypto Wallet security, Binance offers two-factor authentication (2FA) with options like Google Authenticator and hardware keys. Advanced users can enable whitelisting, restricting withdrawals to pre-approved addresses only. The exchange also employs behavioral biometrics and AI-driven anomaly detection to flag suspicious activity—such as unusual login locations or large withdrawals—adding an extra layer to Crypto Security.

Decentralized finance (DeFi) enthusiasts leveraging Binance Smart Chain benefit from smart contract audits conducted by third-party firms like CertiK. Meanwhile, Binance Alpha and Binance MegaDrop, the platform’s newer features, incorporate real-time monitoring to prevent exploits during token launches or staking events. Compared to competitors like Coinbase, Binance’s derivatives trading safeguards include automatic liquidation mechanisms to mitigate market volatility risks.

Behind the scenes, Binance’s blockchain technology infrastructure uses cold storage for 95% of user funds, keeping them offline and immune to hacking. The remaining 5% in hot wallets is insured by leading cybersecurity firms. Additionally, the exchange’s partnership with law enforcement agencies enhances recovery efforts for stolen assets, a critical advantage in the Crypto Market.

For those looking to invest in crypto confidently, Binance’s transparency reports—published quarterly—detail security incidents and resolutions. For example, a 2025 update highlighted how the team thwarted a phishing campaign targeting Binance USD (BUSD) holders. By combining cutting-edge tech with user education (like its Security Awareness Quiz), Binance sets the gold standard for Crypto Trading safety.

Whether you’re a beginner or a high-volume trader, leveraging these features—from whitelisting to SAFU—ensures your portfolio remains secure in an increasingly complex digital assets landscape.

Professional illustration about Bitcoin

Binance Mobile App Guide

The Binance Mobile App is your all-in-one gateway to the crypto trading world, offering a seamless experience whether you're buying Bitcoin, swapping Ethereum, or exploring Binance Smart Chain projects. As of 2025, the app remains the most downloaded cryptocurrency exchange platform globally, thanks to its intuitive design and robust features. Under the leadership of Richard Teng (who succeeded Changpeng Zhao in 2023), Binance has doubled down on regulatory compliance, integrating advanced know your customer (KYC) and anti-money laundering (AML) protocols without sacrificing user convenience.

Key Features You’ll Love:

- One-Tap Trading: Execute trades in seconds with customizable shortcuts for BNB, Binance USD (BUSD), and other top digital assets.

- Binance Alpha: Access exclusive market insights and trending tokens before they hit the mainstream.

- Derivatives Trading: Trade futures and options with leverage, all from your smartphone.

- Binance MegaDrop: Participate in token launches and earn rewards directly through the app.

For Crypto Security, the app supports biometric login (Face ID or fingerprint) and multi-factor authentication (MFA). The built-in Crypto Wallet lets you store, send, and receive coins securely, with optional integration for decentralized finance (DeFi) platforms like Binance Smart Chain.

Binance.US vs. Binance Mobile App: While Binance US caters to American users with stricter regulatory compliance, the global Binance app offers a wider range of blockchain technology services, including staking, lending, and Crypto Market analytics. Competitors like Coinbase may appeal to beginners, but Binance’s depth in derivatives trading and low fees make it a favorite for active traders.

Pro Tips for 2025:

1. Use the Price Alert feature to monitor Bitcoin and Ethereum volatility.

2. Explore Binance Smart Chain dApps through the in-app browser for DeFi opportunities.

3. Leverage Binance MegaDrop for early access to high-potential projects.

Whether you’re a newbie looking to buy crypto or a pro analyzing the Crypto Trading landscape, the Binance Mobile App adapts to your needs. With Yi He (Binance co-founder) emphasizing user education, the app now includes free tutorials on investing in crypto and risk management—making it easier than ever to navigate the fast-paced world of digital assets.

Professional illustration about Ethereum

Binance Staking Rewards

Binance Staking Rewards remain one of the most attractive ways to earn passive income in the crypto trading world, especially for holders of BNB, Bitcoin, and Ethereum. Under the leadership of Changpeng Zhao and now Richard Teng, Binance has refined its staking programs to offer competitive yields while maintaining robust Crypto Security measures. Whether you're a beginner or a seasoned investor, staking on Binance provides a straightforward way to grow your digital assets without active trading.

One of the standout features is Binance Locked Staking, where users commit their tokens for a fixed period to earn higher rewards. For example, staking BNB in 2025 can yield an estimated 5-10% APY, depending on market conditions and demand. Meanwhile, Ethereum staking rewards fluctuate based on network activity but remain a popular choice due to Ethereum’s dominance in decentralized finance (DeFi). Binance also supports flexible staking, allowing users to unstake anytime, though yields are typically lower compared to locked options.

For Binance.US customers, staking opportunities are slightly different due to regulatory considerations, but major assets like Bitcoin and Ethereum are still available. The platform ensures regulatory compliance with know your customer (KYC) and anti-money laundering (AML) policies, making it a secure choice for U.S.-based investors. Compared to competitors like Coinbase, Binance often provides higher staking rewards, thanks to its integration with Binance Smart Chain and other native ecosystems.

Beyond traditional staking, Binance has introduced innovative programs like Binance Alpha and Binance MegaDrop, which combine staking with early access to new tokens and projects. These initiatives leverage blockchain technology to offer additional incentives, such as bonus rewards or exclusive token allocations. For example, users who stake BNB might qualify for MegaDrop events, where they can earn new tokens before they hit the open market.

Security is a top priority, and Binance employs advanced measures to protect staked assets, including multi-signature Crypto Wallets and real-time monitoring for suspicious activity. Users should always enable two-factor authentication (2FA) and avoid sharing sensitive information to minimize risks. Additionally, Binance’s derivatives trading platform allows stakers to hedge their positions, providing an extra layer of financial strategy.

For those looking to invest in crypto long-term, staking on Binance is a smart move. The platform’s user-friendly interface, combined with high liquidity and a wide range of supported assets, makes it a leader in the Crypto Market. Whether you’re staking Binance USD (BUSD) for stable returns or exploring high-yield opportunities with newer tokens, Binance offers flexibility and reliability. As the industry evolves under leaders like Yi He, expect even more innovative staking products to emerge.

Here are a few tips to maximize your Binance staking rewards in 2025:

- Diversify your staking portfolio by allocating funds across different assets like BNB, Ethereum, and stablecoins to balance risk and reward.

- Monitor lock-up periods to ensure your tokens aren’t tied up during potential market surges.

- Stay updated on new programs like MegaDrop or limited-time staking boosts, which can significantly increase returns.

- Reinvest rewards to compound earnings over time, especially with high-yield assets.

With its combination of high rewards, security, and innovation, Binance staking remains a cornerstone of passive income in the cryptocurrency exchange landscape. Whether you’re a casual investor or a DeFi enthusiast, leveraging these opportunities can help grow your holdings in 2025 and beyond.

Professional illustration about Changpeng

Binance NFT Marketplace

The Binance NFT Marketplace has emerged as one of the most dynamic platforms for trading digital assets, blending the power of blockchain technology with the growing demand for decentralized finance (DeFi) solutions. As part of the Binance ecosystem, the marketplace leverages Binance Smart Chain (BSC) for fast and low-cost transactions, making it an attractive option for both creators and collectors. Users can trade NFTs using BNB, Bitcoin, Ethereum, or Binance USD (BUSD), offering flexibility in crypto trading. Under the leadership of Changpeng Zhao (CZ) and now Richard Teng, Binance has prioritized regulatory compliance, including Know Your Customer (KYC) and Anti-Money Laundering (AML) measures, ensuring a secure environment for investing in crypto.

One of the standout features of the Binance NFT Marketplace is its integration with Binance Alpha and Binance MegaDrop, which provide exclusive access to high-profile NFT drops and staking opportunities. For example, artists and brands can launch limited-edition collections, while traders can participate in auctions or fixed-price sales. The platform also supports derivatives trading, allowing users to speculate on NFT price movements without owning the underlying asset. Compared to competitors like Coinbase, Binance’s marketplace stands out due to its lower fees and seamless connection to the broader Binance.US and global cryptocurrency exchange infrastructure.

Security is another major focus, with Binance employing advanced crypto security protocols to protect users’ crypto wallets and transactions. The marketplace also educates users on best practices for buying crypto and managing digital assets, reducing risks associated with scams or volatile crypto markets. For instance, Yi He, Binance’s co-founder, has emphasized the importance of user education in navigating the NFT space. Whether you’re a seasoned trader or a newcomer, the Binance NFT Marketplace offers tools like rarity rankings and portfolio tracking to help users make informed decisions.

The platform’s growth reflects broader trends in the crypto trading industry, where NFTs are increasingly used for gaming, art, and even real-world asset tokenization. By combining blockchain technology with user-friendly features, Binance continues to solidify its position as a leader in the crypto market. For those looking to trade crypto or explore NFTs, the Binance NFT Marketplace provides a robust, secure, and innovative platform backed by one of the most trusted names in the industry.

Professional illustration about Richard

Binance Crypto Loans

Binance Crypto Loans: Flexible Financing for Your Digital Assets

For crypto traders and investors looking to leverage their holdings without selling, Binance Crypto Loans offers a seamless solution. Launched under the leadership of Changpeng Zhao and now steered by Richard Teng, this feature allows users to borrow stablecoins or popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) by using their existing digital assets as collateral. Whether you're a seasoned trader on Binance Smart Chain or a newcomer exploring decentralized finance (DeFi), this service provides liquidity while keeping your long-term investment strategy intact.

How Binance Crypto Loans Work

The process is straightforward:

- Collateralize Your Assets: Deposit supported cryptocurrencies such as BNB, Binance USD (BUSD), or Ethereum into your Binance account.

- Choose Loan Terms: Select your preferred loan amount, currency (e.g., BTC, USDT), and duration (ranging from 7 to 180 days).

- Receive Funds Instantly: Once approved, the borrowed amount is credited to your Binance wallet, ready for trading, staking, or other opportunities in the crypto market.

Unlike traditional loans, Binance Crypto Loans doesn’t require credit checks, thanks to its over-collateralized model. However, users must maintain a Loan-to-Value (LTV) ratio to avoid liquidation. For example, if the value of your collateral drops significantly, Binance may automatically sell a portion to cover the loan—a standard practice across cryptocurrency exchanges like Coinbase and Binance.US.

Why Use Binance Crypto Loans?

- Avoid Taxable Events: Selling crypto can trigger capital gains taxes. By borrowing against your holdings, you access cash without selling, a strategy favored by savvy investors in 2025.

- Flexible Repayment: Pay back early with no penalties or extend your loan term if needed. Interest rates are competitive, often lower than derivatives trading margins.

- Diversify Strategies: Use borrowed funds to participate in Binance MegaDrop, stake in Binance Alpha, or explore other blockchain technology projects without liquidating your core portfolio.

Security and Compliance

Under Yi He’s oversight, Binance prioritizes crypto security and regulatory compliance. The platform adheres to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, ensuring loans are accessible only to verified users. Funds are safeguarded in Binance’s secure crypto wallets, with multi-tier risk management systems monitoring market volatility.

Pro Tips for Maximizing Binance Crypto Loans

- Monitor LTV Closely: Use Binance’s real-time alerts to track your collateral value and avoid liquidation.

- Hedge Volatility: If borrowing volatile assets like Bitcoin, consider stablecoin loans to reduce risk.

- Compare Rates: While Binance offers competitive terms, always evaluate alternatives like Coinbase or decentralized lending protocols in the DeFi space.

For traders navigating the 2025 crypto trading landscape, Binance Crypto Loans is a powerful tool—balancing liquidity, tax efficiency, and strategic flexibility. Whether you're hedging positions or funding new investments, it’s a cornerstone of modern digital asset management.

Professional illustration about Yi

Binance Futures Trading

Binance Futures Trading offers a powerful platform for traders looking to leverage the volatility of the crypto market. Whether you're trading Bitcoin, Ethereum, or other digital assets, Binance Futures provides advanced tools like cross-margin and isolated-margin modes, allowing you to manage risk effectively. With features like up to 125x leverage, it’s no wonder why both retail and institutional traders flock to Binance for derivatives trading. The platform also supports BNB as collateral, giving users additional flexibility and cost-saving benefits through reduced trading fees.

One of the standout aspects of Binance Futures is its deep liquidity, ensuring tight spreads even during high market volatility. Traders can access perpetual contracts for major cryptocurrencies, as well as quarterly futures, enabling strategic positioning in the crypto trading landscape. The integration with Binance Smart Chain further enhances the ecosystem, allowing seamless transitions between spot and futures markets. Regulatory compliance remains a priority, with robust know your customer (KYC) and anti-money laundering (AML) measures in place to ensure a secure trading environment.

For those new to futures trading, Binance offers educational resources through Binance Alpha and Binance MegaDrop, helping users understand advanced strategies like hedging and arbitrage. The platform’s user-friendly interface, combined with real-time data and charting tools, makes it accessible for beginners while still catering to seasoned traders. Additionally, the leadership of Changpeng Zhao and Richard Teng has been instrumental in shaping Binance’s reputation as a leader in the cryptocurrency exchange space.

Competitors like Coinbase have yet to match Binance’s depth in derivatives trading, particularly when it comes to altcoin futures. However, traders should always be mindful of the risks associated with high leverage, as market swings can lead to significant gains or losses. Binance Futures also emphasizes crypto security, with features like two-factor authentication (2FA) and withdrawal whitelisting to protect user funds. Whether you're looking to trade crypto for short-term profits or long-term positions, Binance Futures provides the tools and liquidity needed to execute your strategy effectively.

The platform’s commitment to innovation is evident in its continuous rollout of new products, such as Binance USD (BUSD)-denominated contracts, which offer stability in a highly volatile market. For U.S.-based traders, Binance.US provides a regulated alternative, though with a more limited selection of futures products compared to the global platform. As blockchain technology evolves, Binance remains at the forefront, integrating decentralized finance (DeFi) elements into its futures offerings to stay ahead of the curve.

Professional illustration about Binance

Binance Spot Trading Tips

Binance Spot Trading Tips for 2025: Maximizing Your Crypto Strategy

Spot trading on Binance remains one of the most straightforward ways to buy and sell crypto like Bitcoin (BTC) and Ethereum (ETH), but mastering it requires more than just clicking buttons. Whether you're using Binance.US or the global platform, these tips will help you trade smarter and safer in today’s crypto market.

1. Start with a Solid Trading Plan

Before diving into crypto trading, define your goals. Are you day trading, swing trading, or holding long-term? Use Binance Alpha or Binance MegaDrop to research upcoming projects and market trends. For example, if you're bullish on BNB (Binance’s native token), consider allocating a portion of your portfolio to it, especially given its utility across Binance Smart Chain and fee discounts.

2. Leverage Binance’s Trading Tools

Binance offers advanced features like spot grid bots and TWAP (Time-Weighted Average Price) orders to automate your strategy. For instance, a grid bot can help you capitalize on volatility by buying low and selling high within a predefined range. Also, explore the derivatives trading section if you’re comfortable with higher risk, but remember: spot trading is ideal for beginners due to its simplicity.

3. Prioritize Security and Compliance

Under CEO Richard Teng, Binance has doubled down on regulatory compliance, including KYC (Know Your Customer) and AML (Anti-Money Laundering) measures. Always enable two-factor authentication (2FA) and store large holdings in a crypto wallet (like Binance’s Trust Wallet) instead of leaving everything on the exchange. Avoid sharing API keys unless you’re using verified third-party tools.

4. Diversify with Stablecoins and Altcoins

Pairing volatile assets like Ethereum with stablecoins such as Binance USD (BUSD) can reduce risk. For example, if BTC dips, you can quickly convert part of your position to BUSD to preserve value. Also, keep an eye on decentralized finance (DeFi) projects launching on Binance Smart Chain—they often offer high-yield opportunities.

5. Monitor Market Sentiment and News

Follow executives like Changpeng Zhao (CZ) and Yi He for insights into Binance’s direction. In 2025, regulatory updates or partnerships (like those with Coinbase) can drastically impact prices. Tools like Binance’s Crypto Market tab and social sentiment trackers help you stay ahead. For instance, a sudden spike in blockchain technology adoption could signal a buying opportunity for related tokens.

6. Use Limit Orders to Avoid Slippage

Market orders can lead to unfavorable prices during high volatility. Instead, place limit orders to buy or sell at your target price. For example, if ETH is at $3,500 but you want to buy at $3,450, set a limit order and wait for the dip. This is especially useful during events like Bitcoin halvings or major digital asset listings.

7. Keep Learning and Adapting

The crypto exchange landscape evolves fast. Attend Binance webinars, read their research reports, and experiment with small trades before scaling up. For example, test a new strategy with $100 before committing larger amounts. Remember, even seasoned traders adjust their approaches based on crypto security trends and macroeconomic shifts.

By combining these strategies—whether you’re trading BNB, Bitcoin, or emerging altcoins—you’ll be better positioned to navigate Binance’s spot trading ecosystem in 2025. Stay disciplined, stay informed, and always prioritize risk management.

Professional illustration about Binance

Binance Customer Support

Binance Customer Support: How to Get Help on the World’s Largest Crypto Exchange

Navigating the crypto trading landscape can be complex, especially when you need quick assistance. Binance, the leading cryptocurrency exchange under CEO Richard Teng, offers multiple customer support channels to address issues ranging from Crypto Wallet access to regulatory compliance queries. Whether you're trading Bitcoin, Ethereum, or BNB on Binance Smart Chain, knowing how to leverage their support system ensures a smoother experience.

Binance’s live chat feature is a go-to for urgent issues like failed transactions or derivatives trading errors. For less time-sensitive matters, submitting a ticket through the Help Center allows the team to investigate deeper problems, such as KYC (Know Your Customer) verification delays or anti-money laundering flags. Pro tip: Always include your Binance UID and relevant transaction hashes to speed up resolution.

Beyond formal channels, Binance leverages its massive community. The Binance Alpha and Binance MegaDrop platforms often host AMAs (Ask Me Anything) with executives like Yi He, where users can get insights on blockchain technology updates or digital assets listings. Twitter (now X) and Telegram are also monitored for real-time troubleshooting—though avoid sharing sensitive data publicly.

If you’re using Binance.US, note that its support structure differs slightly due to stricter regulatory compliance in the U.S. While the global platform offers multilingual assistance, Binance US focuses on localized help for crypto trading regulations like state-specific buy crypto laws. Compared to competitors like Coinbase, Binance’s response times are competitive, but complex cases (e.g., decentralized finance disputes) may take longer.

Before contacting support, explore Binance’s FAQ and Academy sections. Detailed guides cover everything from Crypto Security best practices to staking Binance USD (BUSD). For developers, the Binance Smart Chain documentation is invaluable for debugging smart contract interactions.

Final Tip: Always double-check the official Binance domains to avoid phishing scams—a common issue in the Crypto Market. Whether you’re a beginner learning to invest in crypto or a pro navigating derivatives trading, knowing how to access Binance’s support efficiently saves time and reduces stress.

Professional illustration about Binance

Binance KYC Process

The Binance KYC process is a critical step for anyone looking to buy crypto, trade crypto, or access advanced features like Binance Alpha and Binance MegaDrop. As of 2025, Binance has tightened its Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to align with global regulatory compliance standards, ensuring a safer crypto trading environment. Whether you're trading Bitcoin, Ethereum, or BNB on Binance Smart Chain, completing KYC is mandatory for full account functionality. Here's what you need to know to navigate the process smoothly.

First, Binance requires users to submit a government-issued ID (such as a passport or driver’s license), a selfie for facial verification, and sometimes proof of address (like a utility bill). This step is designed to prevent fraud and comply with blockchain technology regulations. Unlike some platforms, Binance’s KYC is thorough but streamlined, typically taking 24-48 hours for approval. For Binance.US users, the process is even more rigorous due to U.S. crypto market laws, often requiring additional documentation compared to the global platform.

Why is KYC so important? Beyond crypto security, it unlocks higher withdrawal limits, access to derivatives trading, and participation in exclusive events like Binance MegaDrop. Without KYC, your account will be restricted to basic functions, limiting your ability to invest in crypto effectively. Competitors like Coinbase also enforce strict KYC, but Binance stands out for its tiered system—Basic, Intermediate, and Advanced—each offering progressively more features. For example, Advanced verification grants higher fiat deposit limits and priority customer support.

Under CEO Richard Teng and co-founder Yi He, Binance has doubled down on transparency, especially after the Changpeng Zhao era. The exchange now uses AI-powered tools to speed up verification while reducing errors. If your submission gets rejected, common reasons include blurry documents, mismatched names, or expired IDs. Pro tip: Ensure your selfie has even lighting and avoid wearing glasses or hats to speed up approval.

For those concerned about privacy, Binance stores digital assets and KYC data on encrypted servers, adhering to decentralized finance (DeFi) security principles. However, if you’re hesitant about sharing personal details, consider that most top-tier cryptocurrency exchanges mandate KYC. The trade-off is access to a secure, feature-rich platform versus limited functionality on non-compliant platforms.

Finally, remember that KYC isn’t a one-time event. Binance may request re-verification if your account shows unusual activity or if regulations change. Staying proactive with updated documents ensures uninterrupted access to Binance USD (BUSD) transactions, staking, and other services. Whether you're a beginner or a seasoned trader, mastering the KYC process is your gateway to maximizing Binance’s ecosystem in 2025.

Professional illustration about MegaDrop

Binance DeFi Integration

Binance has solidified its position as a leader in decentralized finance (DeFi) integration, leveraging its Binance Smart Chain (BSC) to bridge the gap between centralized and decentralized crypto trading. Under the leadership of Changpeng Zhao (CZ) and now Richard Teng, Binance has aggressively expanded its DeFi offerings, making it easier for users to invest in crypto while maintaining robust crypto security standards. The platform’s native token, BNB, plays a pivotal role in this ecosystem, powering transactions, staking, and governance across DeFi protocols.

One of Binance’s standout features is its seamless integration with DeFi platforms, allowing users to trade crypto assets like Bitcoin and Ethereum while also participating in yield farming, liquidity mining, and decentralized exchanges (DEXs). For example, Binance Smart Chain supports popular DeFi projects such as PancakeSwap and Venus, enabling users to earn passive income through blockchain technology. Additionally, Binance’s Binance USD (BUSD) stablecoin ensures low volatility for DeFi transactions, making it a preferred choice for traders and liquidity providers.

For U.S. users, Binance.US offers a regulated gateway to DeFi, adhering to strict regulatory compliance standards like Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. While Coinbase remains a strong competitor, Binance distinguishes itself with deeper DeFi integration, including access to Binance Alpha for advanced analytics and Binance MegaDrop for early access to high-potential projects.

Here’s why Binance’s DeFi strategy stands out:

- Scalability: BSC’s low transaction fees and high throughput make it ideal for crypto trading and DeFi interactions.

- Interoperability: Binance supports cross-chain swaps, allowing users to move assets between Ethereum, BSC, and other networks effortlessly.

- Innovation: Features like derivatives trading and digital assets staking are seamlessly integrated into Binance’s DeFi ecosystem.

However, challenges remain, particularly around regulatory compliance as global authorities tighten oversight on decentralized finance. Binance’s proactive approach, led by Yi He and the compliance team, ensures the platform stays ahead of evolving regulations while maintaining user trust.

For traders looking to dive into DeFi, Binance offers a user-friendly dashboard that aggregates DeFi protocols, tracks yields, and manages crypto wallets—all in one place. Whether you’re a beginner or an advanced trader, Binance’s DeFi integration provides the tools and liquidity needed to navigate the crypto market with confidence.

Ultimately, Binance’s commitment to blockchain technology and DeFi innovation ensures it remains a top choice for anyone looking to buy crypto or explore the future of digital assets. By continuously evolving its ecosystem, Binance sets the standard for what a modern cryptocurrency exchange should offer in the DeFi space.

Professional illustration about Binance

Binance Token Listings

Binance Token Listings remain one of the most influential events in the crypto trading world, often causing significant price movements and attracting global investor attention. As the largest cryptocurrency exchange by trading volume, Binance has perfected its listing strategy under leaders like Changpeng Zhao, Richard Teng, and Yi He. In 2025, the platform continues to prioritize high-potential projects, focusing on blockchain technology, decentralized finance (DeFi), and regulatory compliance to maintain its dominance over competitors like Coinbase.

When a new token gets listed on Binance, it typically gains immediate liquidity and visibility. The exchange employs a rigorous review process, evaluating factors like crypto security, team credibility, and real-world utility. Projects built on Binance Smart Chain (BSC) often receive priority, given the chain's low fees and fast transactions. For traders looking to buy crypto with high growth potential, monitoring Binance’s token listings is essential. Recent additions have included AI-driven DeFi platforms and Layer 2 scaling solutions, reflecting the industry’s shift toward efficiency and scalability.

Beyond standard listings, Binance has introduced innovative programs like Binance MegaDrop and Binance Alpha, designed to give users early access to promising tokens. These initiatives often include staking rewards or airdrops, incentivizing long-term holding. For example, BNB holders can stake their tokens to participate in exclusive launches, blending crypto trading with passive income opportunities. Meanwhile, Binance US adheres to stricter know your customer (KYC) and anti-money laundering (AML) policies, ensuring compliance with U.S. regulations while still offering competitive listings.

The impact of a Binance listing can’t be overstated. Tokens like Bitcoin and Ethereum dominate trading pairs, but newer altcoins often see 100%+ price surges within hours of being added. Savvy investors use tools like Binance USD (BUSD) for stablecoin trading during volatile launches, minimizing risk while capitalizing on hype. Additionally, the exchange’s derivatives trading options allow advanced traders to hedge positions or leverage new listings for short-term gains.

For project teams, securing a Binance listing is a major milestone, but it requires more than just a whitepaper. The exchange prioritizes transparency, crypto wallet integration, and active community engagement. In 2025, Binance has also increased scrutiny of digital assets with unclear tokenomics or weak security audits, reflecting broader industry trends toward investor protection. Whether you’re looking to trade crypto or invest in crypto long-term, keeping an eye on Binance’s listing announcements—and understanding the strategies behind them—can provide a significant edge in the fast-moving crypto market.

Professional illustration about Coinbase

Binance Tax Reporting

Binance Tax Reporting in 2025: What You Need to Know

Navigating tax obligations as a Binance user requires a clear understanding of how crypto transactions are classified and reported. Whether you’re trading Bitcoin, Ethereum, or BNB on Binance Smart Chain, every transaction—from spot trades to derivatives trading—has potential tax implications. In 2025, regulatory scrutiny has intensified, with platforms like Binance.US and Coinbase implementing stricter know your customer (KYC) and anti-money laundering (AML) protocols to ensure compliance. Here’s a breakdown of key considerations for Binance tax reporting:

Tracking Your Transactions: Binance offers downloadable transaction histories, but third-party tools like Koinly or CoinTracker can automate the process, especially for high-volume traders. For example, swapping Binance USD (BUSD) for Ethereum or staking BNB on Binance Alpha counts as taxable events in most jurisdictions.

Understanding Taxable Events: The IRS and other tax authorities classify crypto activities like selling, trading, or earning rewards (e.g., through Binance MegaDrop) as taxable. Even decentralized finance (DeFi) transactions on Binance Smart Chain may trigger capital gains or income tax.

Regional Compliance: Under CEO Richard Teng, Binance has prioritized regulatory compliance, but rules vary by country. U.S. users must report gains using Form 8949, while EU traders adhere to the Crypto-Asset Reporting Framework (CARF). Always consult a tax professional familiar with digital assets.

Common Pitfalls: Overlooking small transactions—like fees paid in BNB or airdrops from Binance Alpha—can lead to discrepancies. Keep detailed records, including wallet addresses and dates, to avoid audits.

Pro Tip: If you used Binance and Coinbase in 2025, consolidate records from both exchanges to accurately calculate net gains or losses. With blockchain technology, transparency is improving, but proactive tracking remains essential for stress-free tax reporting.

Professional illustration about Cryptocurrency

Binance Global Expansion

Binance Global Expansion

Binance continues to dominate the cryptocurrency exchange landscape in 2025, aggressively expanding its global footprint while navigating complex regulatory environments. Under the leadership of Richard Teng, who took over from Changpeng Zhao, the platform has doubled down on regulatory compliance, ensuring adherence to know your customer (KYC) and anti-money laundering (AML) policies across new markets. This strategic focus has allowed Binance to secure licenses in key regions, including Southeast Asia, Latin America, and parts of Europe, where demand for crypto trading and digital assets is surging.

One of the most notable moves in 2025 is Binance’s push into decentralized finance (DeFi) through Binance Smart Chain, which has become a go-to platform for developers building blockchain technology solutions. The chain’s low transaction fees and high throughput make it a strong competitor to Ethereum, especially for projects focused on derivatives trading and decentralized finance. Additionally, BNB, Binance’s native token, has solidified its position as a top-tier cryptocurrency, thanks to its utility across the Binance ecosystem, including fee discounts and participation in exclusive offerings like Binance MegaDrop and Binance Alpha.

In the U.S., Binance.US remains a critical player, though it faces stiff competition from Coinbase. To differentiate itself, Binance.US has rolled out enhanced crypto security measures and expanded its crypto wallet services, catering to both novice and experienced traders looking to buy crypto securely. The platform has also introduced localized features, such as faster fiat onboarding and educational resources, to attract users wary of the complexities of the crypto market.

Meanwhile, Binance’s global expansion isn’t just about geographic reach—it’s also about product innovation. The launch of Binance USD (BUSD) as a regulated stablecoin has provided traders with a reliable gateway between fiat and Bitcoin or other altcoins. Additionally, the Binance MegaDrop initiative has gained traction, offering users early access to high-potential projects before they hit the mainstream crypto trading scene.

However, challenges remain. Regulatory scrutiny in markets like the EU and the UK has forced Binance to adapt quickly, sometimes exiting certain regions or revising offerings to meet local laws. Yi He, Binance’s co-founder, has emphasized the importance of balancing growth with regulatory compliance, ensuring the platform doesn’t sacrifice long-term sustainability for short-term gains.

For traders and investors, Binance’s global expansion presents unique opportunities. Those looking to invest in crypto can leverage the platform’s extensive altcoin selection, while developers can build on Binance Smart Chain to tap into a growing DeFi ecosystem. As Binance continues to evolve, its ability to innovate while maintaining trust will be crucial in retaining its position as the world’s leading cryptocurrency exchange.